Invest confidently with the power of intelligence

Discover the power of intelligence that personalises your ESG stock portfolio at your fingertips.

Sleep better knowing your investment portfolio aligns with your goals and values.

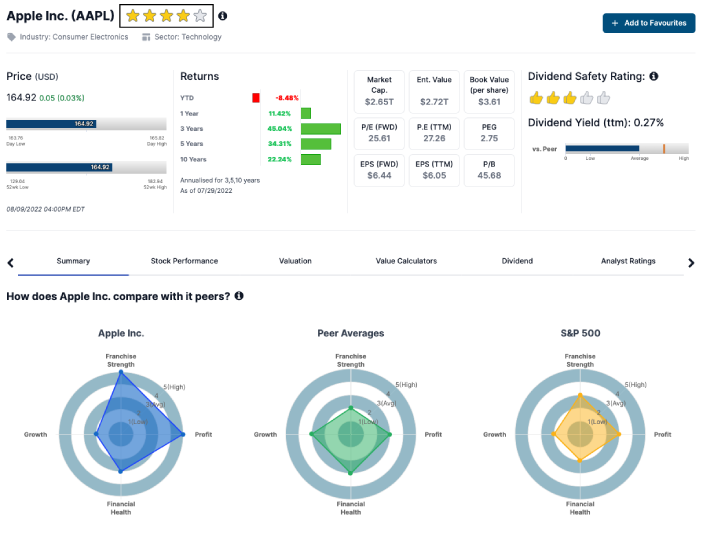

Identify a good investment from mediocre ones and determine its fair value.

Powerful analytics that dig deep into complex financial reports and a user-friendly interface that helps you identify a wonderful company with growth that creates significant long term value.

Compare your favourite stocks using various valuation models. Test your assumptions with our valuation calculators.

Prebuilt views/filters to help you quickly narrow down your choices whether your priority is income, growth or ESG stocks.

Empower you to make the investment choices that are right for you

Discover and compare investment opportunities. Identify winners and create your own customised portfolio in minutes with data-driven analytics. A user-friendly interface to help you make a risk-return trade off decision that fits your goal, risk tolerance and preferences.

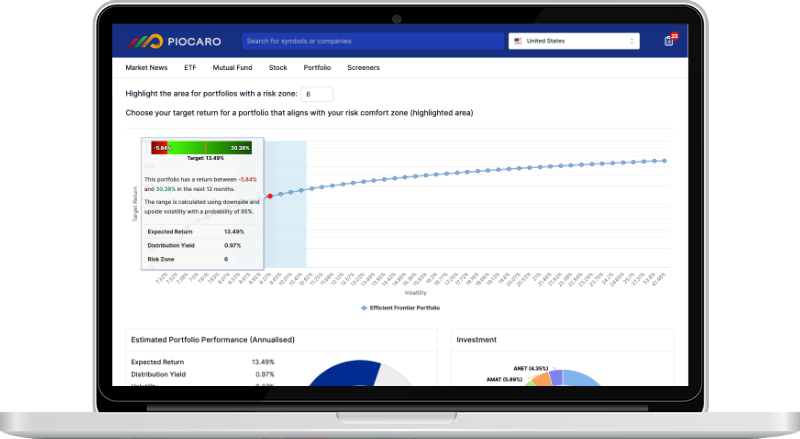

Are you taking the right level of risk to achieve your goal?

Whether you are starting out with investing in a single ETF or a diversified portfolio of stocks and bonds, your investment decisions depend on your goals and risk tolerance.

Assess and quantify your risk tolerance so you can make a better risk-return trade off decision.

Don't know your Risk Tolerance Zone? Get a FREE Risk Tolerance Assessment here.

What you get with Piocaro

With disruptive innovations, we strive to make investing easy, simple and personalised specifically for you whether you do it yourself or with your financial adviser.

- For Retail Investors

-

Automated personalised portfolios that align with your goals and values.Powerful analytics and tools for income, value or growth focused investing.

- For Financial Advisers

-

More time to grow your business and more time to spend with your clients. We automate the portfolio management by harnessing the power of intelligence in our platform.Happy & Confident clients. Model Portfolio days are gone. We automate and manage your client's risk tolerance so each of your clients can be confident in her personalised portfolios.Differentiation in your services. We automate and help you build your organisation's approved security list.