Stock Analytics

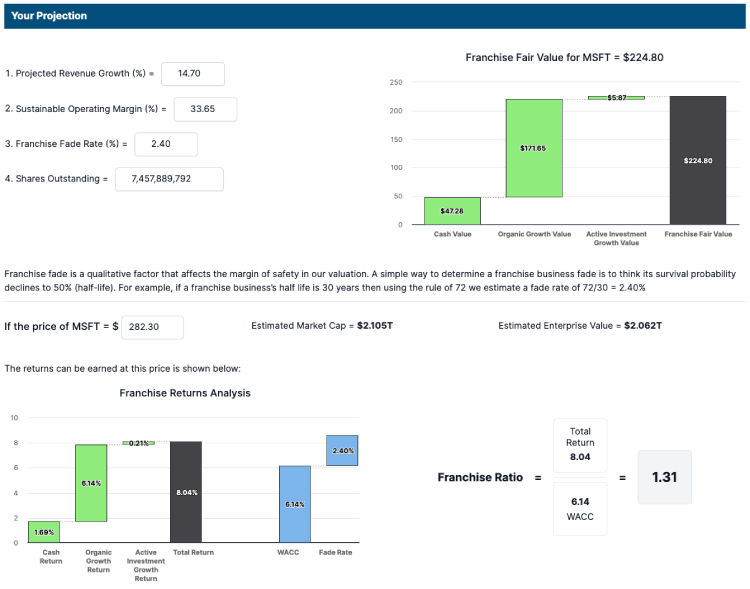

Identify a good company from mediocre ones and determine its fair value.

Warren Buffet once wrote it is far better to buy a good company at a fair price than a mediocre company at a wonderful price. Our stock analytics help you distinguish good companies from the mediocre ones. We believe when you buy a good stock, you own a piece of a wonderful company. It is a company with a sustainable competitive edge, strong financial health to successfully navigate tough economic conditions and generates growth that creates significant long term value.

Our analytics dig deep into a company’s financial reports to quantify and analyse its earnings power, sustainable competitive edge/ economic moat, financial strength, profitability and leverages. We analyse whether a company generates growth that erodes or creates significant long term value. The data-driven analytics and the power of intelligence in our platform enable you to invest with confidence.

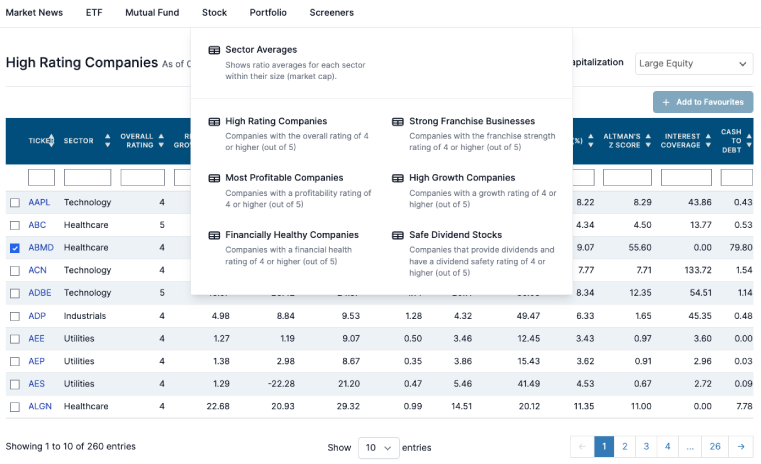

Prebuilt Views

Prebuilt views enable you to quickly narrow down your investment research and security choices whether they are dividend stocks, ESG stocks or your high conviction stocks.

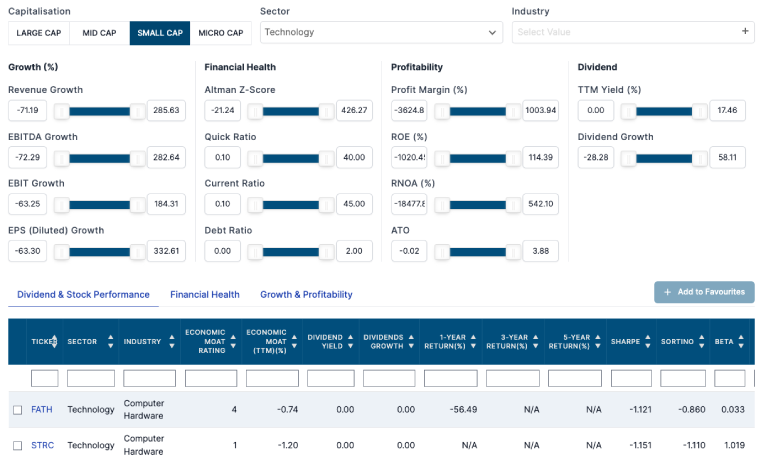

Screeners

Unlike other stock screeners, our made easy stock screener is designed with retail investors in mind. We make it easy for average investors to create and customise their screeners to filter and quickly narrow down their research and security choices.

Retail Investor

Our platform provides a set of tools to help advanced/experienced investors with their research and identifying new investment opportunities.

Financial Adviser

We can help you create your organisation’s unique approved security list to differentiate your service. Our platform provides a set of tools to help you research and hand-pick securities that comply with your organisational investment policy.

See what else you can do with Piocaro

With disruptive innovations, we strive to make investing easy, simple and personalised specifically for you whether you do it yourself or with your financial adviser.

-

Stock Analytics

Identify a good company from mediocre ones and determine its fair value.

-

Fund Analytics

Analytics with intuitive charts to compare funds so you can make intelligent decisions about which ETFs to choose or avoid.

-

Custom Indexing Portfolio

Personalise a stock portfolio using individual securities in your chosen benchmark index in minutes.

-

Smart Portfolio

Automatically construct and personalise a well-diversified portfolio of stocks and bonds in minutes.

-

Portfolio Optimiser

Construct and optimise portfolios from your hand-picked securities list

-

Portfolio Analyser

Analyses an existing portfolio and helps you visualise where the portfolio stands compared to other alternative allocations.

-

Asset Correlation Heatmap

Visualise the correlations across your securities and identify the ones that benefit you the most from diversification.

-

Risk Tolerance Assessment

Assess and quantify your risk tolerance so you can make an intelligent risk-return trade-off decision.

-

Financial Adviser Dashboards

An essential tool to delight your life-long clients and meet the Know Your Customer compliance